Let’s cut right through the panic inducing US Dollar headlines. Mainstream media is touting a deal between Brazil and China, among other deals that are emerging between China and other BRICS nations, as well as Saudi Arabia, as the US Dollar killer. The truth is, the USD is going nowhere.

We have all heard the sound bites. China is on the rise; Russia circumvents sanctions using the Yuan – RMB; Saudi Arabia puts a dent in the petrodollar; BRICS coming up with their own currency. But these are all false moves in the fiat world that will not bring about any substantial change if they succeed at all.

None of these deals are US Dollar killers. Bitcoin is the only true alternative. Although a “Bitcoinized” global economy might become a Pyrrhic Victory.

Yuan Fundamentals

Before going into why Bitcoin is the only real alternative to rise from the ashes of the US Dollar global trade system, it is important to put our fiat caps on first. It is necessary to analyze the fundamentals of the alternatives on the fiat side, starting with the Yuan:

- China exercises capital controls – a topic that people in the BTC space are quite familiar with

- The RMB is pegged to the US Dollar; its monetary policy is de facto set by the Fed

- $860 billion Dollars worth of US national debt is in Chinese hands – Only Japan owns more debt

- An export-led economy like China’s, that suppresses the purchasing power of the average worker, is not an ideal candidate to replace the US in terms of its role as an exporter of reserve currency

Anyone considering that the Yuan would be a good replacement for the US Dollar will have to engage in some mental yoga to explain how the attributes above make it superior.

Imposing Capital Controls on the World?

A world reserve currency under the current international trade regime, which guarantees a degree of freedom of movement for goods and capital, cannot function under the kind of capital controls that China imposes on the RMB. How are people going to trade in a relatively free manner amongst each other – that is, without a significantly greater degree of government interference – if China has such strict controls over foreign investment and currency flows?

The current world trade regime is not entirely free, but it is arguably freer that at any other point in history. It is certainly freer than a system that would rely on the RMB. What is now considered free trade cannot exist without a currency that can flow through world markets in an equally free manner.

Would replacing the US Dollar with the Yuan would lead to the externalization, to an extent, of those capital controls? Where else will you be able to invest with your RMB? How is China going to control its population economically while liberalizing outflows of Yuan in favor of freer trade?

Set your Own Interest Rates First!

Capital controls are deeply ingrained in the Chinese system as a measure of control over the population. When it comes to exchange rates, that same system is looking to make China’s products competitive in foreign markets at all costs through a controlled exchange rate.

China works because its population can feed itself based on an export-led model of production. Nevertheless, China is less innovative than its neighbors – Japan, South Korea, and others. This means that China relies heavily on keeping the “value” of its currency artificially low against the US Dollar. That keeps Chinese wages relatively low and enables the export of goods to feed a vast population of workers with a relatively low purchasing power.

Countries that own an international reserve currency are always net importers. They run a structural trade deficit. This allows the rest of the world to export to the country that “owns” international reserve currency and keep the money as a guarantee of liquidity. The country that “owns” that international reserve currency gets foreign investment back – Triffin Dilemma.

The Destiny of the Yuan in the Hands of US Government Debt

When capital flows back into a country like the US, which currently owns the world’s reserve currency, that capital looks for returns in the bond market as well. Enter the sovereign debt problem that is built into the system.

The RMB in its bid to replace the USD as world reserve currency, would have to solve the USD denominated debt China holds. This debt – essentially US treasury bonds – cannot be traded in for Yuan, or redeemed for anything else other than greenback.

Keeping the exchange rate of the Yuan artificially low to ensure Chinese products can remain competitive in international markets, is a feature of the Chinese system. Selling all that US sovereign debt to sink the US Dollar’s status as reserve currency would create a fatal bug in the CCP’s export-led system.

The move would boost the value of the RMB relative to the USD effectively making Chinese exports less competitive than before. The Yuan is beholden to the US Dollar denominated debt that the Chinese government holds.

A Fly in the Yuan Ointment!

How long will China be able to maintain the Yuan’s exchange rate and an effective control over capital flows, while it simultaneously floods the economy with US Dollars?

Buying raw materials, products, or other inputs in international markets with those Dollars to avoid flooding their own economy with foreign currency, would negate the bid to elevate the RMB to world reserve currency status. China would basically have to set all the cash it gets from dumping US national debt, on fire to have a chance to pull this off.

BRICS Coin Then!

If the Yuan cannot be it, then an experimental currency that we shall call BRICS coin for the sake of brevity and to anchor the conversation, could sweep in and replace the USD. Well, not really. BRICS coin would have its own challenges.

To understand them it is necessary to recognize a few key facts:

- BRICS was never meant to be a trade block

- Chief Economist at Goldman Sachs, Jim O’Neill, coined the term BRICS in 2001

- He did this forecasting that the original 4 economies of the BRICS countries – Brazil, Russia, India, and China – would dominate the world economy in 2050

- But BRICS countries make for odd bed fellows when it comes to international trade

- Brazil and South Africa are quite far away from the rest of their counterparts in this group – a feature that correlates negatively with the likelihood of trade between countries

- India and China have a degree of animosity towards each other to say the least – including a series of deadly skirmishes on the Indian side of the Himalayas in 2020 and 2021

- Russia’s energy infrastructure was developed to face Europe over the last 30 years. A shift will require significant investment

- BRICS economies are not necessarily well integrated or in many cases, complementary, making the degree of possible integration lower

The leading economy within the BRICS coalition, China, imports raw materials from Russia, Brazil, and other countries to produce goods that it sells primarily to consumers in the US. There, it would have to take USD to sell its products. Apart from that, none of the BRICS countries is about to give up any kind of monetary freedom by bounding itself to a single currency; BRICS coin is stillborn.

Look at the Euro

The second most popular currency for international trade is the Euro. That experiment was so fraught with failures and regrets that BRICS countries would do well to take it as a cautionary tale.

Even then, the Euro doesn’t face the kind of headwinds that BRICS coin does. Euro zone economies:

- Are highly integrated

- Enjoy geographic proximity

- Complement each other

- Produce a wide range of products and services that enjoy worldwide prestige and can be absorbed by EU member countries to a higher degree than BRICS goods in their home countries, except for India

The Euro is the second most traded currency in the world. It enjoys a robust, integrated and well-diversified industrialized economy behind it, but it still could not replace the US Dollar as the main conduit for international trade.

Where the Yuan and BRICS Coin Fail, China and Saudi Arabia Will Surely Prevail!

Some would say that no entity or government behind the Euro ever sought to dethrone the US Dollar and that is why the greenback still dominates. The EU as a whole, whether its members operate under the Euro or not, is a direct result of the US international trade system. So, basically, the USD based international trade system created the conditions necessary for the rise of the Euro.

China itself as well as all the BRICS nations – Russia might be more of an exception – have flourished within the USD global trade system. China is signing its own bilateral agreements to denominate trade in Yuan much like EU nations denominate trade in Euro. But will this produce a true rival to the greenback? Or will it just be another example of how other currencies can be used within a USD dominated global trading system?

The point in case would be the recent talks between Saudi Arabia and China, with the latter being the biggest buyer of the former’s crude. Mainstream media would lead you to believe that Yuan denominated trade in oil markets, is a Petrodollar killer.

Saudi Arabia sells its oil to numerous other countries that would much rather transact within the US-led financial system than within a Chinese one. These include China’s very own backyard rivals, Japan and South Korea.

Oil producers are also more likely to settle oil contracts in USD because they can use Dollars more easily to invest in other countries, buy other products in international markets, and diversify their economies.

The Euro – which Iran tried to use already in 2006 to circumvent US sanctions – or even the UAE Dirham, might also be more attractive than the Yuan if the aim is to dethrone the Petrodollar. Other Gulf nations – all fossil fuel exporters – would much rather trade in any other strong currency than in RMB as they look to diversify their economies and import what they cannot produce locally.

Establishing Trust Takes Time. Just Ask Newly Minted Bitcoiners!

For the time being, the trust element for any alternative to the greenback is also missing. Oil producing gulf countries or virtually any other country, would still find it more advantageous to get paid in USD because most countries in the world still trust the greenback.

So, what if China and Brazil agree to settle their $150 billion USD worth of bilateral trade in Yuan? That is a drop in a bucket. As much as $150 billion Dollars is quite a significant amount of money, it doesn’t even represent 1% of what the US economy is worth.

There is also no proof of concept yet. The transactions are not actually there to substantiate these bilateral agreements in terms of payment settlements, although the Yuan is already used in about 2% of international transactions.

At any given point nations can withdraw from any of these new commercial agreements and demand payment in USD. That is likely to happen especially if trust in an alternative to the greenback falters.

De-Dollarization or Regionalization?

Russia would be an exception to the trust issue. Given the sanctions, Russia must use other currencies, which exposes another issue with the whole mainstream media de-Dollarization headline frenzy: The Russian economy is way less dependent on global trade than most other countries. Russia must take whatever it can, but it also doesn’t have to engage in global trade as much as its BRICS counterparts to survive.

That might expose our biases when it comes to the future of the greenback. The retreat of the Dollar looks like a symptom of a more significant underlying condition. What if we are seeing a generalized movement towards de-globalization or regionalization, and the expected decline in the use of USD will match the decline in global trade as a whole?

Dollarization vs Yuanization

In such a case, maybe the Yuan will play a more significant role within Asia – West Asia probably, given the complementary nature of energy exporters and China as an energy importer. But this does not mean the US Dollar will be replaced at all.

The greenback will instead play a larger role in North America and to a certain extent in trade between North and South America, as global trade retreats and becomes regionalized. Some economies, notably in the Americas, are already dollarized:

This list could be expanded to include a number of countries that peg their currency to the US Dollar, effectively surrendering their monetary policy to the Fed. A list of countries that use any of the alternatives to the USD, aside from the Euro, British Pound, or Swiss Franc, namely any of the existing BRICS currencies, with the exception of the South African Rand in neighboring nations, is inexistent.

Bitcoinization?

Going back to the list of countries that are currently Dollarized, El Salvador is of particular interest. If Bitcoinization will ever take place, it is important to look at the country that opted into Bitcoin without giving the Yuan much of a thought.

But El Salvador is a small country that accounts for a negligible fraction of world trade. Its move into Bitcoin does not mean that BTC can play a role as reserve currency where the Yuan cannot.

Another important point to make about “Bitcoinization” is that so far no other currency has risen to prominence without robust sovereign power behind it. BTC could perhaps become the alternative for weaker states, those that cannot muster too much power on the world stage. That is something to think about as the Dollar retreats, especially if other nations are willing to explore welcoming Bitcoin as an alternative.

Reshoring

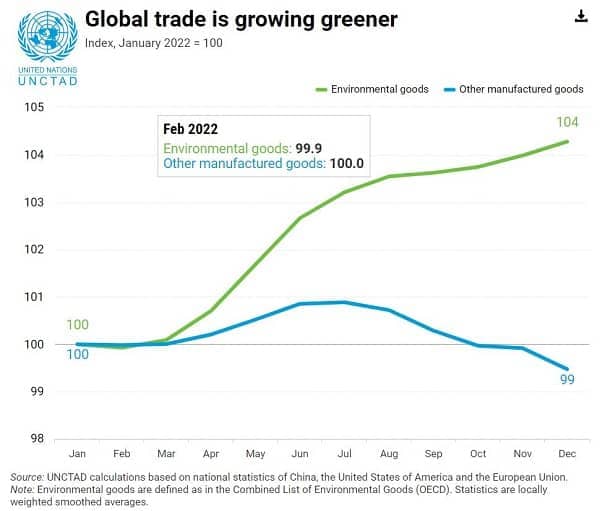

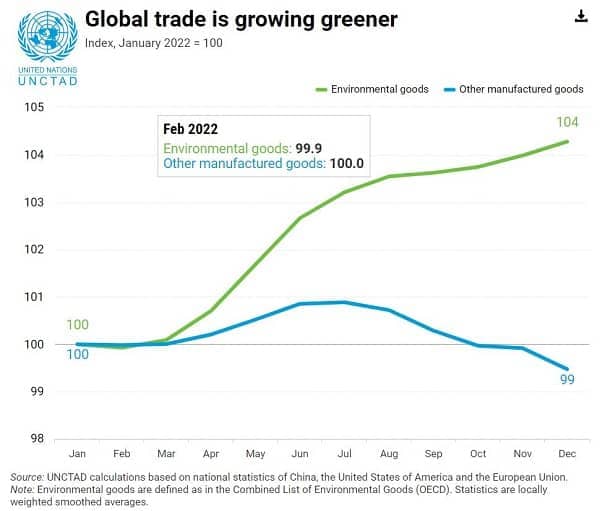

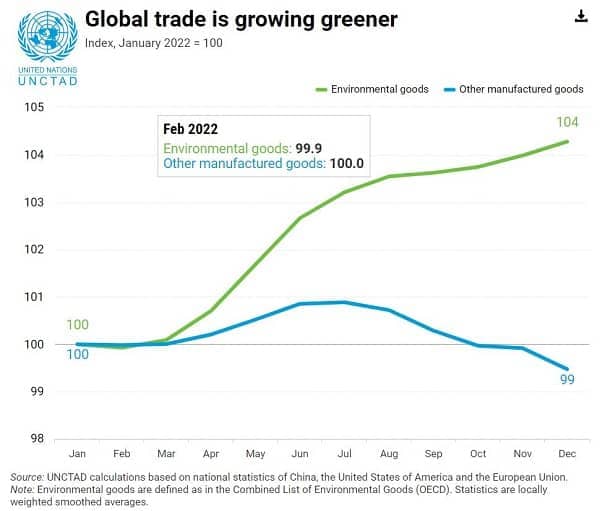

Another challenge for any USD replacement, be it Bitcoin or an inferior fiat alternative, could be a negative trend in global trade. Data clearly shows that in 2022, global trade declined. As the greenback retreats, what we see is shifting supply chains. There is no “Bitcoinization” or any kind of USD replacement on a global scale for that matter, just less trade.

There is evidence that apart form Russia – which was strategically positioned to become more autarkical – the US and other countries are either reshoring or friendshoring their industrial base. The US government has even gone as far as to restrict trade with China. Mexico has been filling the gap in certain industrial niches where it is now more competitive.

The US is switching its supply chains towards friendlier nations – like Vietnam, Taiwan, and the NAFTA+ sphere instead of China – or reshoring production entirely – Trump’s policy. It seems that global trade as we know it, cannot continue as we replace the USD with another currency.

Be it BRICS coin, RMB, a gold-backed cryptocurrency that Russia and Iran control, or any other in the long list of options that plague mainstream media headlines these days, none will be as prominent as the USD once was. Reshoring and friendshoring are going to kill global trade as we know it before any other currency claims the vacant throne the US is leaving behind.

The Bitcoin Angle

A retreating USD exposes the glaring failure of fiat currency and the current global trade regime. It also highlights the lack of a proper alternative within the national-supra national spectrum in a digital world.

Until 1971 a gold or silver standard of some sort was the norm. Then came fiat, and a few decades later the explosion of digital everything. Even if the world goes back to a gold backed national or supra national currency, and global trade does not collapse as the US retreats:

- Who is going to trust foreign governments to be transparent about how much gold they actually have in hand to back the currency?

- Are we going to go back to the Spanish empire era in which boatloads of gold fell to piracy?

- Is it possible that a currency backed by gold like the US Dollar before 1971, will be attacked by foreign entities just like the USD was, leading those at the helm to ditch gold backing?

- Which of the nations that seek to replace the USD have the naval prowess to at least secure a significant amount of gold going from point A to point B on a ship if any entity wants to redeem its gold or trade with it?

Russia, China, India, Brazil, and South Africa do not have blue water navies. The resources required to acquire such a force would probably put their finances under great strain and jeopardize the very currency they are trying to replace the greenback with.

The only real alternative here is Bitcoin. But then again, this would require some country other than the US and its allies policing the high seas. A demise of the US Dollar heightens the risk of a resurgence in piracy. World trade can decrease substantially as a result.

Less Global Trade Backed by Bitcoin

It is difficult to see how the current global trade system can survive the demise of the USD. US security promises will go the way of the greenback. Bitcoin might eventually be crowned the king of a much smaller global trade kingdom. There is no other real alternative, especially given the terrible history of government sponsored currencies.

Bitcoin offers:

- Relatively fast payment settlement

- No need for deploying expensive military equipment to secure any kind of transaction

- A completely agnostic system that is difficult for nation states to hold hostage – because global trade dominated by any other national or supra national currency is subject to the political will of the state or states that mint and control said currency

- Currency availability can be verified easily on a system that does not require the establishment of trust

Will we Love Bitcoin Backed Global Trade?

As much as there are advantages to a Bitcoin backed global trade system, there are no guarantees that we will like it once we compare it to the golden age of the system it is bound to replace. Nevertheless, there seems to be no other option that fits. That is, if we are given a choice at all.

World reserve currencies have been established by the use of force or credible threats of overwhelming use of force. The Yuan, BRICS coin, or any other alternative will not be different in that regard either. Only Bitcoin offers an ostensibly peaceful alternative, and it will only rise to the extent that:

- People start using it more

- Those in control of the weapons allow others to use it

- Governments are willing to give up monetary control at least

What to Expect as the US Dollar Retreats?

In the meantime, it would be wise not to jump to any conclusions. Although there is no superior fiat alternative to the greenback based on merit alone, governments are armed and dangerous. The elites that derive power from them will spare no effort to maintain their status.

That status is and will be based on control over any fiat alternative, or any other classic medium of exchange like gold or silver. Unfortunately, Bitcoin is not in their cards for obvious reasons. Therefore, all responsible entities and individuals will probably want to diversify and hedge. The USD is going nowhere, which means you should expect more silly mainstream media headlines and increasing risk ahead.